The insurance field is one of the oldest businesses out there, having begun centuries ago with simple cargo insurance. Nowadays, though, it has evolved far beyond its origins, particularly into the realm of health. Moreover, anyone can take out a policy without leaving their home, all thanks to health insurance app development. However, this convenience isn’t just something that sprung up spontaneously.

Without health insurance software development, insurance companies would not be able to offer their services so seamlessly and in any part of the world. That’s why businesses nowadays are using dev teams to modernize and reach more clients. In today’s comprehensive guide, JetBase will show you how to do just that.

Using our decade-plus experience, we will talk about health insurance app types, reasons to invest in an app, must-have features, and the development process. Our assessment will highlight both the pros and cons of implementing such software. In the end, we hope you understand the peculiarities of health insurance app development.

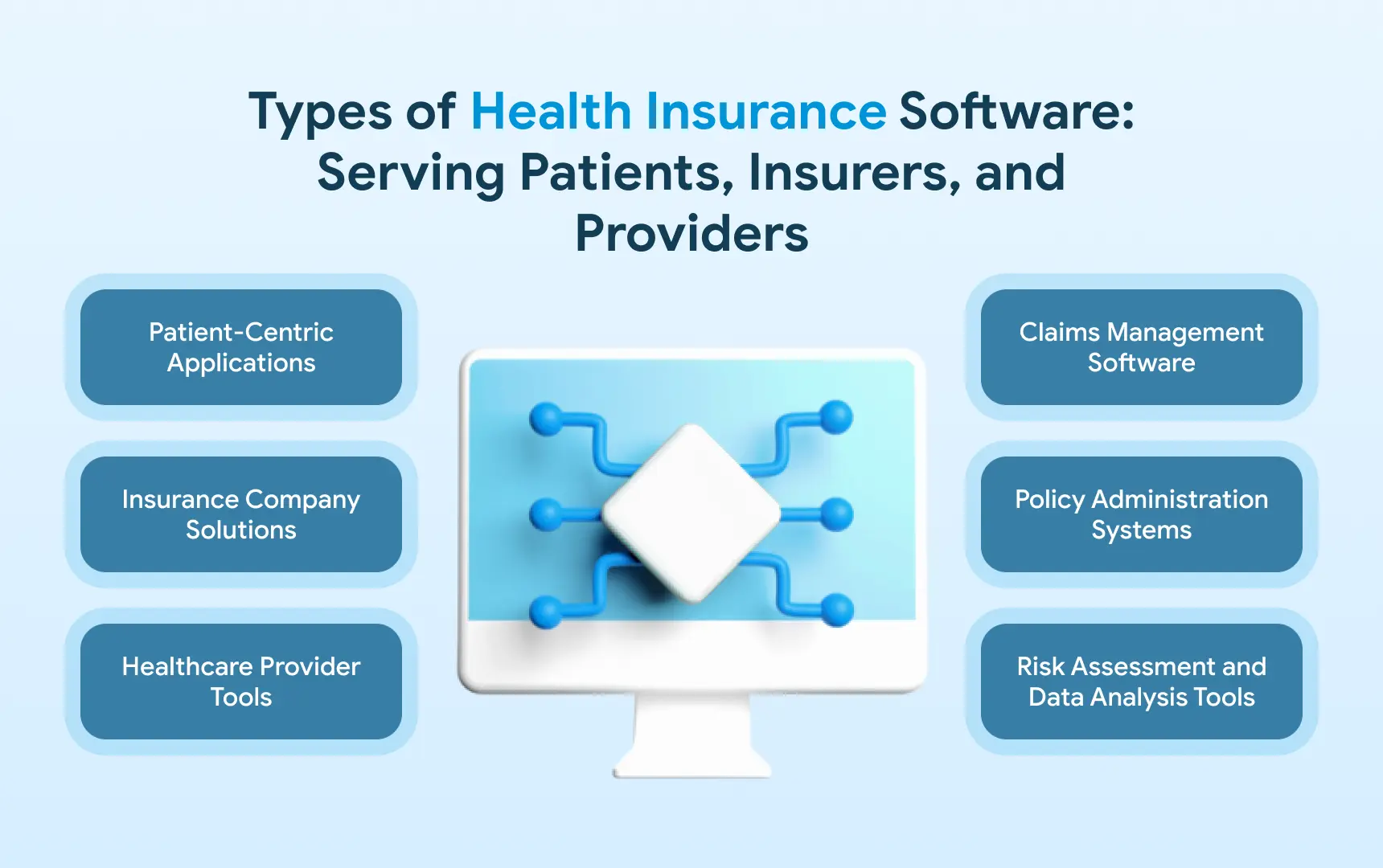

Health Insurance Software: Definition and Types

Starting off with the basics, what kinds of health insurance app can you develop? There’s a surprisingly rich selection, as some apps will focus on serving the customers, others help automate internal work, and others create integrations. We will go through all of them, explaining what each does.

Patient-Centric Applications

The name is self-explanatory here, as you use these apps to service customers. These can range from simple policy trackers to robust suites where a patient can:

- Request compensation

- Edit or upgrade their policy

- Contact representatives

- Reach out to healthcare providers

Depending on how much you’re willing to invest in health insurance software development, you can create a portal that fulfills all patient needs. As a result, you’ll be offering them a way to remotely manage everything related to insurance.

Insurance Company Solutions

Next are apps that help with day-to-day processes that keep insurance companies running. This can include paperwork processing, client databases, some policy control, and client outreach. As this is essentially the flipside of client-centric apps, this type of health insurance app can also range from basic to feature-rich. The choice is all yours.

Healthcare Provider Tools

Medical institutions are also part of the insurance ecosystem, which means they’re stakeholders in health insurance app development. Tools for healthcare providers include:

- Integrations with insurance databases

- Patient processing

- Payment data storage and processing

- Policy verification

Basically, these need to cover a hospital’s interaction with a patient from an insurance-centric viewpoint. They need to confirm a policy is active and covers particular procedures, relay payment information to the insurer, and treat the patient.

Claims Management Software

The bulk of work for a health insurance company lies in processing claims. This includes deciding whether to pay them out, requesting additional data, and storing old claims. Having software makes all of this easier, as it structures the work and secures claim data, in addition to providing tools that speed up management.

Policy Administration Systems

Similar to claims, this type of health insurance app is all about working with policies. With these, you can renew or cancel policies, inform clients of lapsed policies, and securely transfer policy data to partners. This helps make insurance processing at hospitals faster and easier for the client, as well as easing policy work for the business.

Risk Assessment and Data Analysis Tools

Insurance companies need to weigh a lot of factors when determining a client’s insurance price and payouts, their legibility for insurance, and general business risks. Health insurance software development covers these use cases, offering tools to analyze risk, assess a patient based on available data, and make decisions.

Such apps are all about data-based choices, eliminating uncertainty and the chance of human error. It can make complex modeling and risk calculations fast and simple, especially if you’re willing to rely on AI-powered functionality.

Why Your Business Should Develop Health Insurance Software

Now that you know what kind of software you can create, let’s talk about what makes the whole process worth it. While health insurance software development isn’t free and will likely require external help from companies like JetBase, its advantages are massive. This section will cover the most common benefits of using health insurance software.

Enhancing Customer Experience

Any business should strive to do better for its customers, as this not only improves their reputation and, in turn, profit but also gives people incentive to come back. Creating a high-quality health insurance app will make your company easier to work with. It means faster response times, convenient claim submission, and easy navigation of the whole insurance process.

Boosting Operational Efficiency

How long is the period between your first contact with a potential customer and them becoming your happily insured client? Whatever the answer is, it can be better. Streamlining operations through health insurance app development will cut expenses and speed up processing. Plus, it can reduce your employees’ workloads by automating minor tasks.

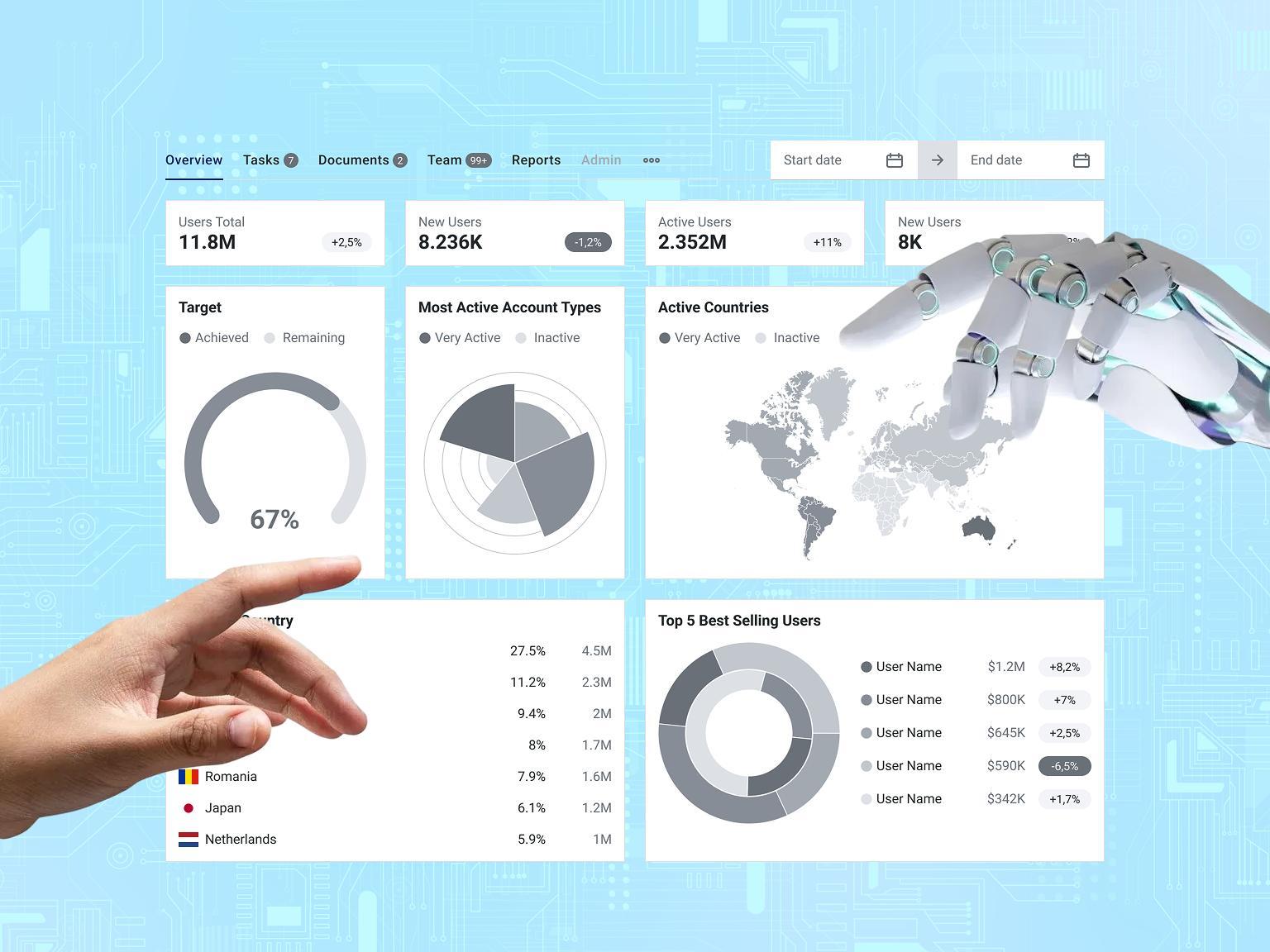

Leveraging Data for Better Decisions

As we mentioned above, an insurance company must make hundreds of decisions every day. Many of them have major financial implications. This is why having more high-quality data and ways to analyze it is absolutely invaluable. By developing a health insurance app, you can ensure that you’re always making the right choice.

Key Features to Include in Health Insurance Software

Your app must be good to reap all the benefits we’ve described. It means having all the right functions and serving as a convenient tool for both internal and external use. Thankfully, that is a very achievable goal, and JetBase will help you with that by taking you through the essential features of a health insurance app.

User Registration and Profile Management

This applies chiefly to customer-facing software, as you want each client to have a private page that lists their data. A secure authorization process helps ensure that data truly remains private, while a robust profile lets them feel welcomed. Personalization and easy access to policy information are a simple way to make that page meaningful.

Claims Processing Automation

With 530,000 claims for more than $88 billion, the insurance industry has a lot to process. That’s why offering a way to automate at least parts of the process is essential, from accepting a claim to sending out a response. This will greatly reduce the time needed to work on a single claim, leaving more time for deliberation.

Policy Management and Renewals

Policies are the other integral part of an insurance business, and your health insurance app should have ways to work with them. This includes policy renewal, upgrades, and cancellations. The function should apply to both customer- and internal-centric apps, as it will make policy work easier for your agents and your clients.

Remember that any customer data, including policy information and claims, must be encrypted at rest and in transit. Your reputation and customer privacy both hinge on that.

Integration with External Services

Having a direct connection to hospital networks and payment gateways lets you process claims and payouts much more efficiently. Instead of sending out manual data requests, you can have instant sync that informs your decisions. This also allows patients to fill out claim reports faster, taking their own data from their medical institution.

Real-time Data Analysis and Reporting

We talked about fast and data-driven analysis as one of the advantages of health insurance software development, so you must have that functionality. This allows your system to passively process cases while your employees confirm the analysis results and make decisions based on them.

Health Insurance Software Development: Step-by-Step Guide

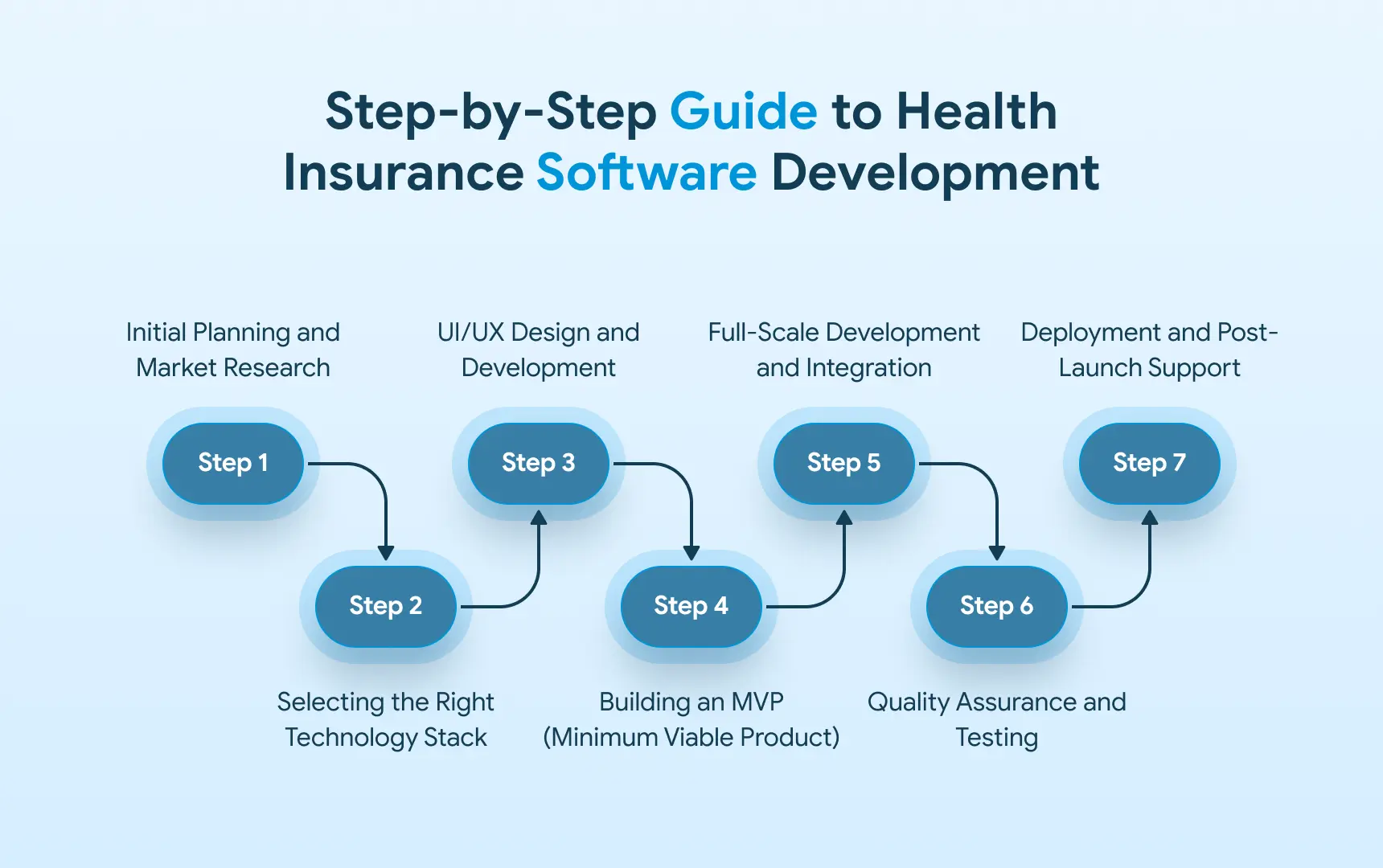

With the benefits of health insurance app development and its essential features out of the way, let’s get to the main course. This section will cover the actual process of creating an insurance app, taking things step by step. While it’s based on JetBase’s own experiences, it is a universal methodology that you can expect from any vendor.

1. Initial Planning and Market Research

It’s important to go into development well-prepared, and that starts with extensive research. For one, it’s possible that the health insurance app you’re planning to make already exists, just made by someone else. It’s also possible that looking at the competition will inspire you with cutting-edge features or a new tech stack.

Planning also gives you room to assess the budget, set a reasonable deadline, and determine the size and makeup of your team. Investing sufficient time and resources into it will pay off with successful and well-structured health insurance software development.

2. Selecting the Right Technology Stack

Once you have planned out your app and the goals you want to achieve with it, it’s going to be easier to pick the perfect tech stack for it. This will depend on the platforms you’re launching on, the features you want, and what you prioritize. Some may want a lightning-fast and simple app, while others will opt for complex systems.

Note that your tech stack has to match the team you pick for health insurance app development. That, of course, will heavily influence the final cost, as well as your app’s usability.

3. UI/UX Design and Development

Your app’s design should be the focal point early on, as it influences the final product greatly. For example, whether you’re making an app for internal use or customers, it must be easy to navigate, as it needs to be usable for everyone. Similarly, if the app is for one company, it should reflect its branding and ethos.

Iterative testing, preferably with the target audience’s feedback, is a must here. Decide on a look and feel for your software before you move on with health insurance app development.

4. Building an MVP (Minimum Viable Product)

Before you go all out on the development, it’s important to create an MVP first. It serves as a basic proof-of-concept and lets you assess the app’s performance. You will see what works and what doesn’t and make adjustments before the next step.

That way, your team will implement the full features with full certainty that the course you’ve set for health insurance software development is correct.

5. Full-Scale Development and Integration

This is where the biggest part of the work happens, as your team implements all the features, sets up third-party integrations, and pushes new versions for verification. It’s important to keep backups during health insurance app development. This way, if something breaks or you prefer an older build, it’ll be easy to restore things.

It’s also the time to secure your app data, encrypting storage and transit processes. Otherwise, you risk leaking sensitive information or suffering a data breach. Since you’ll be dealing with medical data, this is simply not an option. So, make sure to prioritize security when you develop your health insurance app.

6. Quality Assurance and Testing

To guarantee that your app will work properly and be a hit with customers, it’s important to polish it up before you’re done. That means letting the QA team conduct extensive testing, from basic bug hunting to load testing and security verification.

Some companies hire external consultants to assess their app’s security and do penetrative testing. This is a good idea if you want to prioritize security and confirm no bad actors can gain access to your data.

7. Deployment and Post-Launch Support

Once your health insurance app is done, it’s time to unveil it. Deploy the final versions to the relevant platforms and app stores and get ready for the feedback. This initial reception will help you understand what’s missing and what works well. Plus, it’s your chance to market the app if you wish to sell it to other companies.

Work doesn’t end at launch, though, as health insurance software development includes post-launch maintenance, updates, and support. This can range from bug fixes to onboarding to managing the servers. Discuss this beforehand with your vendor and make sure their post-launch services match your needs.

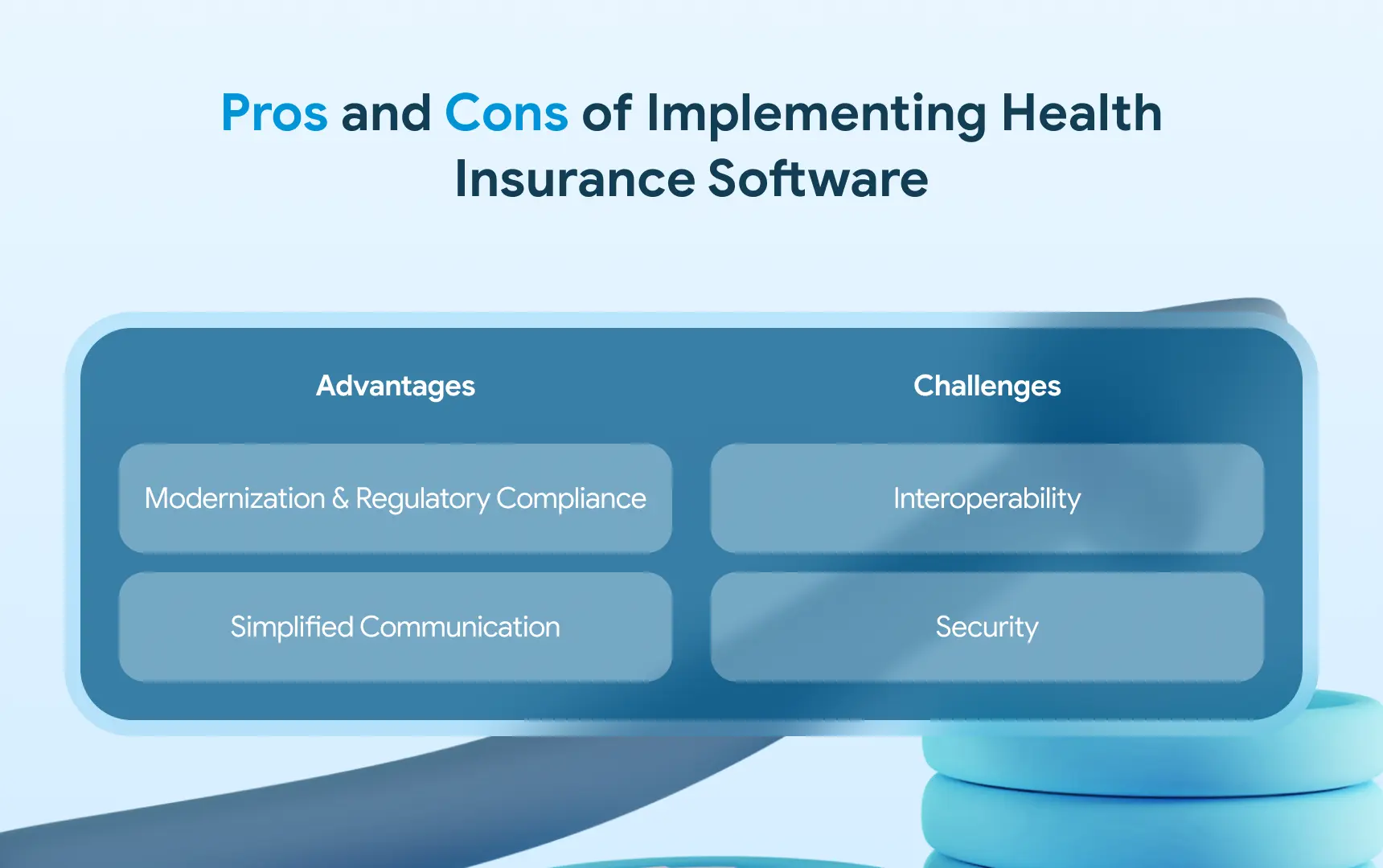

Pros and Cons of Implementing Health Insurance Software

While using a health insurance app should ideally be a positive-only experience, some companies do face issues associated with them. In this section, we’ll address those challenges and explain how to navigate them. However, we’ll also tackle the advantages of health insurance software development to present a balanced view.

Advantages

Let’s start with the good, here’s what you can get when you integrate a health insurance app into your system. This is, of course, assuming that everything is done correctly. But if you partner up with a company like JetBase, success is assured.

Modernization and Regulatory Compliance

Though some may worry about moving the traditional insurance processes into the digital realm, research shows that software can fit this industry just fine. In fact, it makes things easy by offering security for your data and easy ways to give customers control. This falls in line with HIPAA and GPDR while making it much simpler to store files and share them with hospitals.

Simplified Communication

Whether it’s between branches or between your customers and agents, health insurance app development opens up new ways to communicate. Template answers, encrypted file sharing, and AI-powered chatbots all help to relay info faster and resolve issues or questions. As a result, you have an easier time processing the claim backlog and onboarding new clients.

Challenges

However, health insurance software development doesn’t always bring perfect results. Sometimes, this is due to a lack of planning or dev skill; other times, it’s just about structuring your work with the app properly. Here are two common issues that can arise when you use your health insurance app.

Interoperability

Most medical institutions nowadays use their own custom health software, which may sometimes lead to problems for your app. Your software can clash with theirs, resulting in an inability to share data or properly sync it for real-time transmissions. This requires adapting on both of your sides, as well as your teams working together to establish connectivity.

Security

There’s a reason why the security of your health insurance app is a challenge and not a problem. If you’re working with a capable team, they should be able to keep intact encryption for all data, as well as protect your backend with authorization access management. However, any slacking in this aspect of health insurance app development could cause big problems. Hence why it’s a challenge and one that will stay relevant through the app’s lifespan.

Real-Life Examples of Health Insurance Software Apps

Talking about theoretical benefits is one thing, but it’s easier to show off the utility of a health insurance app with a practical example. In this section, we will highlight a couple of success stories, each proving that insurance software can bring immense value to a business.

PLEXIS

A veteran in the health insurance market with a 20-year tenure, PLEXIS offers a major suite of features for insurance and healthcare companies. For one, it automates data input and claim processing, making it easier to work with clients. Then there’s the software’s API, which makes it highly interoperable, enabling connections to other databases and institutions.

It’s also a health insurance app focused on scaling, which helps it support a ton of simultaneous processes. This sort of optimization becomes vital for large insurance enterprises and hospitals, as it can efficiently process the data of all patients and clients.

Oscar

On the patient side of things, Oscar is a multi-platform app that specifically helps patients find the right insurance and doctor for them. It incentivizes a completely digital connection between patient and care provider, with remote sessions, in-app documentation, and payment processing. As a result, patients can easily handle all insurance and medical processes while still having a broad choice of insurers.

The company is also training AI to analyze clinical documentation, speeding up patient processing and powering its chatbots to offer comprehensive assessments. While it’s not the focal point of the app, it’s exciting to see a health insurance app embrace fresh technologies.

What to Consider When Developing Health Insurance Software

Before you dive into health insurance software development, it’s important to include a few factors in your development plan. For one, ensuring that your software fully complies with HIPAA regulations is essential. Hiring a legal consultant specializing in local healthcare regulations may be worth it. You're good to go if they confirm that your software complies with all necessary rules.

Then there’s the question of storage. While you can store data on-premises, which gives you more control, many businesses opt for cloud storage instead. This option makes it easier to sync data between multiple branches or with your partners, in addition to cutting storage costs. It may be the optimal choice for those seeking convenience.

It’s also important to know your software’s “identity.” Do you want a robust system that covers many tasks at once and serves as a full replacement for physical documentation and work? Or is a straightforward health insurance app for your customers more cost-effective? Analyzing the market and your own clientele will help make this decision, which will set the course of development.

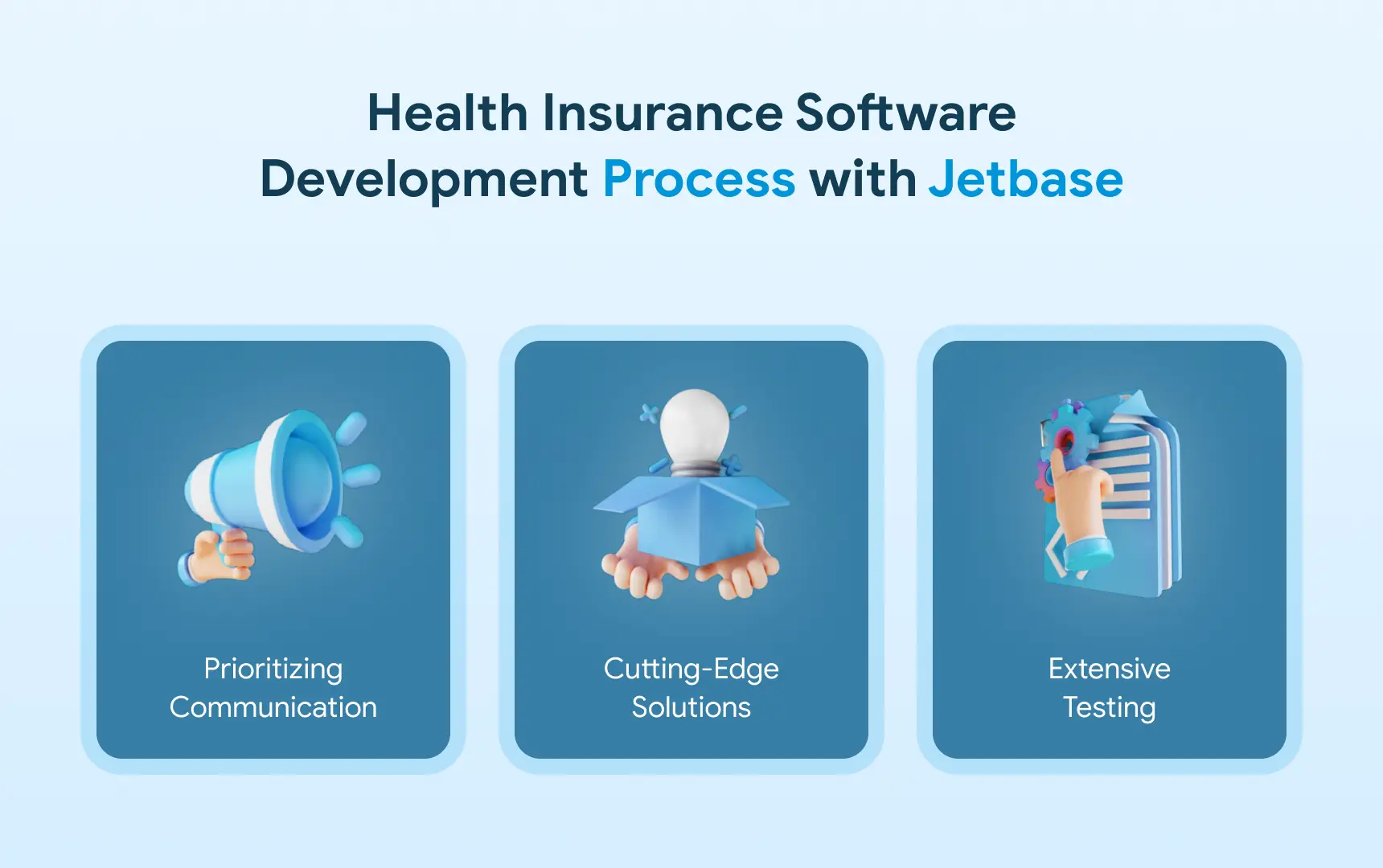

Health Insurance Software Development Process with Jetbase

Every company has its own approach to software creation and it’s only fair that we highlight how we do things. This can both inspire you for your own in-house work and prove that JetBase is a great pick for outsourcing your health insurance software development. We’ll describe a couple of things that define our collaborations, and you can judge for yourself.

Prioritizing Communication

Whether we’re making a health insurance app or any other kind of software, our team puts an emphasis on regular check-ins and reports. This helps customers remain connected to our progress and have control over day-to-day processes. We always listen to feedback and incorporate it to cover our customers’ wishes.

Cutting-Edge Solutions

Our portfolio includes work with many platforms, including the buzzy VisionOS, as we’re always looking for innovative solutions to software challenges. This means that our creations are highly optimized, scalable, and remain relevant for years to come. The JetBase team is constantly on the lookout for new ways to impress and refine our craft.

Extensive Testing

No application can achieve its full potential when it’s plagued by bugs and errors. JetBase focuses on our apps’ level of polish, conducting testing every step of the way. Thanks to this focus on QA, we guarantee that your software’s release version will run like clockwork. Plus, we provide extensive post-launch support, offering updates and maintenance for the software.

Make Your Own Insurance App with Jetbase

The best way to ensure your health insurance app development goes smoothly is to get the help of a professional team. Thankfully, you just read a guide from just such a team - JetBase. Our decade-plus of market experience and tailored approach to each customer make us a prime choice. But, in addition to that, we’re also experts at making modern custom solutions.

For example, we’ve worked with HIPAA compliance before, making a healthcare web app requiring extensive integrations. Our team ensured interoperability with remote patient monitoring and IoT connections.

We’re also no strangers to creating bespoke SaaS products with cloud architecture and AI support. This experience will no doubt be useful in modernizing your insurance business as we make a powerful health insurance app with cutting-edge technology.

If years of experience and versatile tech expertise sound appealing to you, as we’re sure they do, you know exactly who to turn to. JetBase is your one-stop vendor for all of your custom development needs. Reach out now to schedule a consultation for health insurance software development.